Is the housing market going to crash? What's next with home prices, the appreciation of homes, and housing affordability? All will be revealed, right now!

Welcome back to another real estate market update! I’m Erik Braceland with Braceland Homes here in sunny San Diego, California, where we guarantee the sale and/or purchase of your home. Here is where I share the latest news related to buying and selling residential real estate.

Now, first question, housing crash coming? Housing bubble? I'm not going to leave you in suspense. No and no. I know. You literally can't turn on the news, or look on the internet, and not see or hear something about a housing bubble or the impending housing market crash. I recently posted on the Braceland Homes blog about this with a post titled, “Two BIG Reasons Why We Are NOT in a Housing Bubble.”

That blog post centered around this graphic right here. This shows home values going all the way back to World War II. The reason we go back to World War II is, that was the start of the modern-day housing boom here in this country. When service members came back from the war, the GI Bill provided for education, and affordable home loans, so they could go out and buy a home. Ever since then, there’s only been one time in this country, where homes lost significant value. And that was back in 2008.

Back in 2008 we saw homes lose value mainly for two reasons. First reason was loose lending standards. You could qualify for a home with no income, no job, and no verification...and we know how that ended up. The second reason homes lost value during the housing crash was because of cash out refinances. People took the equity they had, cashed it out, bought jet ski, boats, RV and went on expensive vacations, financed through their homes. They did this thinking the exploding home appreciation would never end. But we now know it ended poorly. So let’s recap what happened there. Folks that couldn't afford homes in the first place, applied for loans they didn't have to qualify for, and then they took the equity from those homes, cashed it out and spend it. That’s essentially how we ended up with the housing crash in 2008.

So back in 2008, loose lending standards really drove the housing crisis. Today the bottom line is, lending standards are nothing like they were in the early 2000s. There’s two components that this report by the urban institute outlines. The red area there, product risk, or the mortgage industry. You'll see that's now, since 2008, been virtually eliminated through regulation. The brown portion is borrower risk. Think about that as asset profile, credit score, all the things it takes to qualify for a loan, and those also have been severely reduced through stricter standards. It’s gotten harder to qualify for a loan since the housing crisis. This graphic tells the story of the differences today between back then.

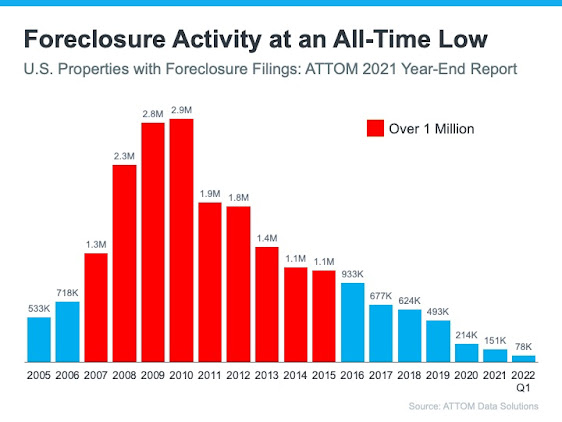

If you need further proof of how this is playing out in the housing market, just take a look here at foreclosure activity since 2005. The foreclosure market in this country is at an all-time low. To be perfectly transparent, there’s been a moratorium on foreclosures in place since the pandemic started. The federal government stepped in and said "we’re not going to process these foreclosures during the pandemic". And while we certainly don’t want to see anybody go through that, we will see a small number of foreclosures once the government lifts the moratorium, but nothing like the numbers we saw from 2007 through 2015, where there were over one million foreclosures per year.

You can also look at the loans that have been given to people with a credit score less than 620. Very few in comparison to the years leading up to the housing crash. So we can clearly say lending standards are different, and one of the major contributors of the crash back in 2008 is no longer around.

So the housing market isn't going to crash, and we're not in a housing bubble. That's good, but what lies ahead for us in the real estate realm? What does the rest of this year have in store? The Fed started off the month by raising the Fed funds rate. A lot of questions about that, as well as talks of a recession down the road. Home prices are going up. Interest rates are going up. So, a lot of questions about what’s ahead. Let me give you some perspective.

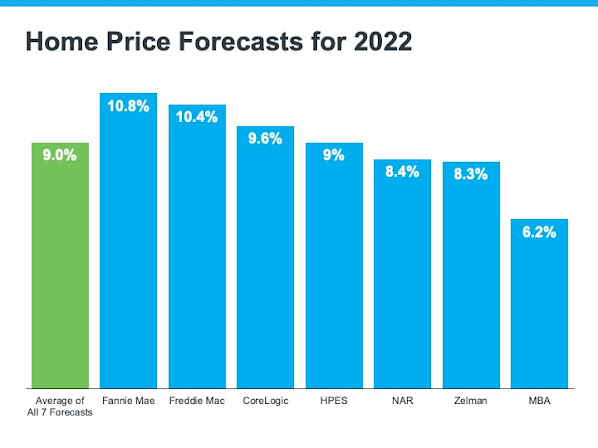

The most recent, updated, home price forecast, from seven of the leading industry forecasters, average 9% home price appreciation across the board right now for 2022. You may hear people, and even the media, saying that homes are going to lose value later in the year, but that's certainly not what the experts are saying.

If we look beyond this year, at this home price expectations survey, for the first quarter of this year, they’re again calling for 9% appreciation this year. We see alignment here, for this year, with the average from the forecasters illustrated on the last graphic. And then beyond this year, we move into what I’m going to call, a much more normal rate of home price appreciation. Before the pandemic, the average home price appreciation was about 3.8% in this country. And you see things returning to those levels for the next four years, after this year. Anybody wondering, is this the top of the market? Should I buy right now? These forecasts for home price appreciation going forward, may help you in making a powerful and confident decision on what to do next in regard to buying or selling your next home.

Now I want to quickly take a look at housing affordability. I know home prices seem completely out of control, right? And we can see right now that housing affordability is really approaching more historical levels. If you're new here, this is the Housing Affordability Index. It goes all the way back to 1990. And if you follow me, you’ve definitely seen this before. Anyway, with this index, the higher the bar, the more affordable homes are. If you look closely here, you'll see it's not so much that homes have been a really great value over the last decade or so. Homes now are not as affordable as they were over the past 10 or 12 years, and certainly not as affordable as they were in those orange bars, which was during the housing crisis. That’s when distressed properties dominated the market. Homes were being sold at a massive discount. We’re certainly not there. And as we’ve seen prices rise, and mortgage rates rise, homes are not as affordable as they were even over the past couple of years.

It’s important to remember that housing affordability is really a measure of three key things. I mentioned home prices and mortgage rates, but it’s also wages. Right now, all three of those things are ticking up, but historically, over the past couple of years, mortgage rates have kind of offset some of the rising prices. We’re no Longer sitting in that seat, so people are now feeling affordability challenges. It is important to keep this in context, and remain positive. Even though homes are less affordable now than the last decade or so, they are still MORE affordable than the two decades leading up to the housing crash! People are making better wages, and mortgage rates, although they are on the rise, are still lower than any time prior to the housing crash!

No comments:

Post a Comment