Will the recession impact the housing market? Will housing inventory increase? Should you buy a home now or wait? Stick with me here for and I'll answer these questions and more.

Hey there! I'm Erik Braceland with Braceland Homes here in sunny San Diego California.

A recent article from The Wall Street Journal says seventy-five percent of global Chief Executive Officers, or CEOs, say that we are now in a recession, or will be in the next 12 to 18 months here in the US. So is there a recession looming, or are we already in one? I don't want to get too down into the weeds on this because I'm not an economist, but a commonly used explanation of how recession occurs, is when we have two consecutive quarters of negative GDP, or Gross Domestic Product. And that's where we are right now. So yes, the economy is slowing. And if you're wondering how recession affects real estate, you're in the right place. While none of us has a crystal ball, we can examine and use historical indicators to predict how a recession affects the housing market. So let's do that!

Throughout history, during recessionary periods, as shown here, interest rates go up at the beginning of the recession, and then, to come out of recession, interest rates are lowered to stimulate the economy moving forward. The recession periods are highlighted here in yellow. Historically, we’ve seen repeated upticks in interest rates followed by subsequent lower interest rates.

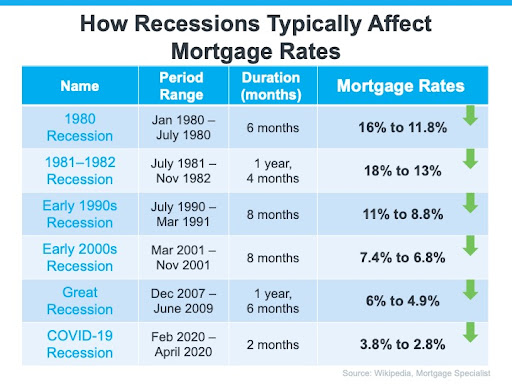

Reconfiguring this same data in table format really drives the point home about interest rates spiking during a recession, and then falling on average one point eight percent over the last six recessions. Which recession was the worst? It really depends on what data points you are interested in. In the real estate industry, things were most heavily impacted in the early eighties and again during the mortgage meltdown from 2007-2009. And you can see that here in the far-right column of this chart. That's a pretty remarkable and consistent trend! Of course this isn't always indicative of what’s going to happen in the future. And I can't guarantee this will happen again during this period of recession, but we CAN pair our knowledge of what's happened in the past, with our good sense, and our local housing market expertise, to make sound decisions on how to execute on our real estate goals.

And I want to remind all of you, and those of you that are new here, a recession doesn’t equal a housing crisis. Forget about what you are seeing and hearing in the mainstream media. Those are sensationalized headlines circulated for one purpose...ratings, clicks, views. Ok, I know, that's more like three, but they're all the same thing. These media outlets know that fear drives more views than anything else. Well fear and gossip. Anyway, I'm here to be your calming voice of reason. Look. We already looked at how recession affects real estate in relation to mortgage rates. Now here's what happened to home prices, during all the recessions, going all the way back to the early eighties. What do you see? Four out of the six times we were in a recession, homes appreciated. Two times they fell. Once, marginally in the early nineties and the other time was in 2008. 2008 is the one most of us remember, and the word recession took on a new meaning for us because of that time. Many people were hurt, a lot of people were impacted, a lot more saw family members that were hurt. But I think the majority, now has a solid understanding of what happened there, and how to prevent it from happening again.

Is housing inventory increasing? Yes! Good news for you home buyers. Finally! More housing inventory...well sort of. I know the last few years have been just awful for you. Right now, you have more homes to choose from than you've had for a long time...but not for the reason you're probably thinking of. I'll explain shortly. And, there is less competition for those homes. Nice.

Let's break this down. First we’re seeing less offers received. Really since April, the multiple offer situation has been slowly tapering off. Right now, there are still homes receiving multiple offers, but there are many more that aren't receiving any offers. The recent rising mortgage rate environment is really starting to soften buyer demand. We’re also seeing the number of offers over asking price declining. A month ago, well over 50% of homes were getting offers above the asking price, and now less than 50% of homes are receiving these generous offers. And that's a product of the reduced buyer activity and competition. Still great for you home sellers, that homes are selling above asking, but you may have to settle for an asking price offer on your home or even one that is below your target sale price. You may also have to make some repairs, or give up some seller credit to the buyer, to close the deal if your homes isn't in exceptional condition. Not the end of the world, but also not what we've been conditioned to the last few years. Home sales are softening as well. I'll spend more time on this in just a bit, but we are definitely starting to see a slower pace of sales. With all of these factors in play, what does that mean for inventory?

That IS the big question. Inventory is actually on the rise and we'll take a look at that in more detail in just a moment. But what's driving this increase? Are more sellers listing their homes right now? To some extent. But the slowing of home sales, is really the biggest contributor, to the increase of housing inventory, at the moment. So what we really have is the Same housing inventory, with fewer home sales, giving us more months of housing supply.

We can see that rise in months of housing inventory here. Now keep in mind that a balanced, or neutral housing market requires approximately six months of housing supply. And by that, I mean not a seller's market, or a buyer's market. So we see here where we started in January, with a record low housing inventory, and this has slowly but steadily increased as the year has gone on.

So why is that? In addition to home sales slowing, new monthly listing counts are also increasing. That’s what you can see here. You can see the green bars are last year and the blue bars are this year. The thing that really strikes me, when I look at this graph, is the fact that the increase in listings, starting in April, overtook the number of listings for that month in 2021 for the first time, and has continued to do so since. That’s huge. That means that there are more new listings coming to the market this year for buyers, and you home buyers now have more options available.

And again, at the same time that pace of home sales is slowing. And what you can see in the green bar over on the right, is that we are projected to end the year, with 5.4 million home sales by the end of 2022, if we continue at the pace we’re selling homes today. Now, we know that that pace has softened because of rising rates, economic pressures, inflationary pressures, all the things that are impacting the housing market right now. When we compare this year to last year and the year before, we have to remember that the housing market is slowing to more of a normal year in real estate, as evidenced by the years preceding the pandemic. 2020, and 2021 especially, were absolutely incredible years for home sellers in particular. They were an anomaly in the housing market. But where we are today in that green bar, is returning more towards the direction of those pre-pandemic years which were also great years in real estate. So when we think about this contextually, yes, the pace of sales is slowing, but we’re slowing back to the pre-pandemic years, which were also fantastic years for the housing market.

Should you buy a home now or wait? With more inventory coming to the housing market, many of you are asking me, should I buy a home right now? My answer to that question is, and always will be, Yes...if it's the right time for you and your family. Trying to time the market is really just a fool's errand. None of us know what the market is going to do, and please don't let anyone convince you that they do...because they do not. If you want to make a move, or you need to make a move, and you can afford to do so, then do it, because it will make your life better. And be thankful you have the ability to do so! It's really that simple. It's true the average mortgage payment has gone up significantly, and that’s a barrier to home ownership for many of you. And it causes others to pause to see what will happen with future mortgage rate shifts. I recommend you speak with me or someone like me, and find a way to make it happen. The market will continue to fluctuate up and down, and when it's time to make another move, it probably won't matter what the market is doing then either. If you sell high, you're going to buy a replacement property in that same market, and buy high. Or you'll be in the reverse situation , sell low and buy low. If this is your first purchase...great. Get in now, because even with the ups and downs, the trajectory of real estate is always up. So if you wait, you're almost always waiting for that real estate to become more expensive! You also may be worried about overpaying for your new home, or have concerns about the bottom falling out of the market right after you buy. We all have, or have had these concerns. Let's address these.

Here we see home prices are predicted to continue rising throughout the year by seven of the leading industry forecasters. Not a one of them saying that prices will fall, and the average increase across the group is forecast to be 8.5%. So all Forecasters are calling for appreciation, and also at a very respectable rate. That should alleviate some of your fears of over overpaying or loosing value in your new home.

Let's explore that at an even deeper level with the findings, shown here, of the Home Price Expectation Survey. If you're new here, this is a quarterly survey of one hundred of the leading economists and housing market experts across this country. Here we have the consensus of those experts' opinions. So we see a forecast similar to the prediction on the previous slide for rising home prices in 2022. We can also see home prices are predicted to continue rising, although at a slower pace, for the next five years. Again, there is no guarantee, and no one knows for sure about these things, but there's a whole lot of intellect and research coming together here, to indicate that your next home purchase will be a sound investment.

Good luck to all of you out there planning to make a move in the near future. If you and your family are ready for a move, tune out all the noise, and just do it! Like I always say, if there's a will, there's a way! I'm already all booked up for July, but I am accepting a very limited number of new clients, for the month of August. I'll personally work you, one on one, to sell your current home, or to purchase a new home. Please call or text me direct at 619-947-3560. I hope to hear from you real soon!