Braceland Homes Inc. is an Escondido, CA real estate brokerage founded in 2018 by retired US Navy officer Erik Braceland (DRE 02059069). Erik launched his second career after several underwhelming experiences with REALTORS® he worked with to buy and sell his own investment properties while serving on active duty. His systems, processes, and strategies positively impact the way homes are sold, and the systematic trademarked approach he embraces, guarantees his clients' satisfaction and success.

Friday, January 28, 2022

When Is The Best Time To Sell Your Home?

Wednesday, January 26, 2022

Why Pre-Approval Is Key for Homebuyers

Why Pre-Approval Is Key for Homebuyers

You may have heard that it’s important to get pre-approved for a mortgage at the beginning of the home buying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a pre-approval letter prior to making an offer. Here’s why.

Being intentional and competitive are musts when buying a home this year. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Just as important, being able to present a pre-approval letter shows sellers you’re a qualified buyer, something that can really help you land your dream home in an ultra-competitive market.

With limited housing inventory, there are many more buyers active in the market than there are sellers, and that’s creating some serious competition. For more on this, check out our latest video:

According to the National Association of Realtors (NAR), homes today are receiving an average of 3.8 offers for sellers to consider. As a result, bidding wars are still common. Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war.

Freddie Mac explains:

“By having a pre-approval letter from your lender, you’re telling the seller that you’re a serious buyer, and you’ve been pre-approved for a mortgage by your lender for a specific dollar amount. In a true bidding war, your offer will likely get dropped if you don’t already have one.”

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing. Interest rates are rising, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals, like we have here at Braceland Homes, making sure you take the right steps and can show your qualifications as a buyer when you find a home to purchase. Give us a call today at 619-947-3560.

Bottom Line

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the home buying process. Not only does being pre-approved bring clarity to your home buying budget, but it shows sellers how serious you are about purchasing a home.

Friday, January 21, 2022

Lowest Housing Inventory Ever in San Diego

Lowest Housing Inventory Ever in San Diego

We're facing record low housing inventory in San Diego, and many other areas across the country. How low...can these housing inventory levels go?

Welcome back! I’m Erik Braceland with Braceland Homes here in sunny San Diego, California, where we guarantee the sale and/or purchase of your home. Here on the Braceland Homes blog we cover topics related to buying and selling residential real estate, and trends happening across the housing market.

I want to show you what's going on with housing inventory in our San Diego real estate market, and other markets here in the US. So, don't jump ship just because you're not here soaking up the sunshine here with us in San Diego. There's something here for all of you...and maybe I'll even convince you to move here at some point. As an added bonus, I've decided to include recent footage we've taken of local neighborhoods and hotspots, as well as some hidden gems here in San Diego County throughout these videos. That's what's going on behind me right now. I'll leave some info about this location in the description, so check that out, and leave a comment to let me know if you like this. We'll take a look at why housing inventory is so low, and how that will impact you as a home buyer, and/or a home seller. So that’s my goal over the next roughly 10 minutes. Quick disclaimer, since my last video, I did get invisaliners installed in my mouth, so I'm gonna do my best to speak without a lisp. If you don't already know, invisaliners are just those invisible braces that folks get now. Much more comfortable than the old metal-mouth braces I originally had as a kid, but still an adjustment to the old routine. Alright, you Ready? Let's do it!

First a quote from or friends at Calculated Risk. “It is possible that rising mortgage rates will slow the housing market. Or the fed might raise rates sooner than expected due to the recent pickup in inflation. But I believe one thing is certain: housing inventory will tell the tale.” And you know, I believe that’s the truth. Housing Inventory will tell the tale. Listen, there’s so much speculation in the housing market right now. What’s going to happen with mortgage rates? What’s going to happen with the Fed? What’s inflation doing? Let’s add coronavirus to that, and all the different variants. So much out there, people speculating on, and its impacting real estate, just as it is everything else. But I can guarantee that inventory will be the market indicator this year.

The bad news is: home listings are at record lows. Over the last couple of years, if one thing has been true...it is that low mortgage rates, people’s definition of home, and people’s desire to own a home, have depleted housing supply all across the country. Number of different reasons for that. We’ve covered those extensively in past videos. Probably the biggest contributing factor right now, is home sellers delaying the sale of their home because they don't want to face the same trials and tribulations that all you home buyers and real estate investors are up against right now. And we'll take a deeper look at that shortly, but most home sellers need to purchase a replacement home, whether they are moving up or down-sizing. The bottom line is, home listing activity is at record lows.

Let's look at a graphic representation of this. This is a look at housing inventory year over year. Realtor.com looked at where we were in December 2020. And where we are now in December 2022. So just a month ago. The most recent data. The national average you see kind of at the middle of the bottom of this slide, almost 27% down year over year. So only a year ago, when housing inventory was at already at record lows, we had 27% MORE homes available for purchase! Unbelievable! And now you can look across the country. Idaho kind of leading the way with an extreme dip of 55% down there. But most of the country in this lighter brown color somewhere between 15 and 30% down. Here in California, we're just above average at almost 28%, meaning we have slightly LESS homes available than the national average, but no doubt a significant lack of inventory across the country.

Now, the truth is, right now in real estate, we will not be able to reach market potential, because you can't buy and sell what isn't available. We're stuck in a negative inventory cycle caused by multiple factors including all those sellers delaying the marketing of their homes. So amazing opportunity continuing for those of you home sellers out there willing to list. Maybe. If there was more housing inventory, you’d probably see more homes sold in this country than ever before...by a lot. But the homes just aren't there right now. I’m not saying it’s impossible to buy a home right now, but I do understand the frustration for those of you looking to buy a home. Conversely this also effects most home sellers because most of you need a replacement home. Not too many home sellers fortunate enough to be liquidating second and third homes simply to take advantage of the generous sale prices.

If we look at this overview going all the way back to 2019, we can see months of inventory in residential real estate, all the way back to January of 2019. So, starting here in January of 2019, we have four months, on average, let’s call it, in supply. We dip down in 2020, and spike back up during the lockdown in April and May of 2020. And then sort of depleting our housing inventory since then. We had the record low housing inventory in December and January last year of under two months’ supply. And now we’re right near that as well. So, inventory is sort of edging lower each year as we move on. That’s the bottom line with housing inventory right now. We just don’t have what we need for a healthy housing market.

I do want to give you a quick look at our San Diego housing shortage, so you can observe the extremes of some of these inventory levels. Earlier we talked about how the California housing inventory was down by almost 28 percent year over year, but if you look here you can see our San Diego housing inventory is down over 50% with just three thousand two hundred and twenty-eight homes for sale in December 2020, and recently only sixteen hundred homes for sale in December 2021. I said it before and I'll say it again...Unbelievable! I also wanted to show that, even with our traditionally low inventory, compared to the national average, our housing inventory in San Diego hasn't even come close to this extreme low level in over a decade.

With that image in mind, You home buyers and real estate investors will need to really stay focused on your end game. Understand that you'll surely face competition for the home you want, and will certainly pay more than you'd like to for that home. Just remember to align yourself with a great real estate agent to navigate the bumps in the road, contract headaches and negotiation stressors. The right real estate professional is really crucial to your success in a market like this. And stay focused on all the positives that acquiring that new home will bring.

What about you home sellers? You in for a treat on the sell side. Relatively quick, easy sales with little or no concessions, and great profit...if your home is marketed properly by a skilled agent, and, it is what buyers are looking for. Caution; Do not get greedy and overprice your home! I see this constantly right now. Home owners see what has been happening, and want to get one point five million dollars for their one million-dollar home. Don't be that person...unless you want to alienate seventy-five percent of your potential buyer prospects, reduce your price multiple times, and double or triple your market time. Pricing is super important! Price your home right, and let the market determine the actual price limit. Yes, everything is basically selling right now, but you can still endure a greatly protracted, stressful, and miserable home selling experience if you aren’t careful with your sale.

That’s the bottom line with inventory right now. We just don’t have what we need for a healthy housing market. How low can it go? We'll see. It's not going to get better overnight, but I do believe more inventory is coming, and when it does we'll start to see some relief with home prices. Whether you need to make a move right now, or you are in the early discovery stages, it's always helpful to align yourself with a great Realtor that can guide you through the process, explain different scenarios, strategies and tactics to you, and answer questions as they come up. So, don't hesitate to call me at 619-947-3560 if you are planning to make a move.

Tuesday, January 18, 2022

Achieving the Dream of Homeownership in San Diego, California

Achieving the Dream of Homeownership in San Diego California

Homeownership has long been considered the American Dream, and it’s one every American should feel confident and powerful pursuing. But owning a home is also a deeply personal dream. Our home provides us with safety and security, and it’s a place where we can grow and flourish.

Yesterday, we remembered the legacy of Dr. Martin Luther King, Jr. Many of us will remember his passion and determination for the causes he championed, including his famous “I Have a Dream” speech in 1963. As we reflect on his message today, it may inspire your own dream of homeownership. And if so, know you’re not alone. You can begin your journey toward homeownership in San Diego by answering the questions below.

1. Where Do I Start?

The process of buying a home is not one to enter into lightly. You need to decide on the areas or neighborhoods in San Diego you like, how much space you need, what kind of commute works for you, and how much you can spend. Without an unlimited budget, it's impossible to get everything you want in a city like San Diego. Look at the following diagram, and choose two or three of the following options to prioritize and concentrate on during your home search:

Then, when you decide you’re ready to buy, we'll help you apply for a mortgage. Lenders (the banks that loan you the money for your mortgage) will look at several factors to determine how much you’re able to borrow, including your credit history. Lenders want to understand how well you’ve managed paying your student loans, credit cards, car loans, and other past debts.

According to Freddie Mac:

“To get a rough estimate of what you can afford, most lenders suggest that you should spend no more than 28% of your monthly gross (pre-tax) income on your mortgage payment, including principal, interest, taxes and insurance.”

2. How Do I Save Enough for a Down Payment?

Speaking of how much you can afford, you’ll want to know what to save for a down payment. While the idea of saving for a down payment can be daunting, there are many different options and resources that can help.

According to Business Insider, automatic savings can bring you one step closer to achieving your target down payment:

“If you receive your paycheck as a direct deposit, you may want to arrange for your company to send a percentage of each check directly into a savings account for the down payment. . . . The automatic-savings strategy makes it so you don't have to constantly remember to save money.”

Before you know it, you’ll have enough for a down payment if you’re disciplined and thoughtful about your process. And the best part is, you may need to save less for your down payment than you think....as little as 3% for a conventional loan...or 0% down for a VA loan! At Braceland Homes, we can help you understand your options.

3. How Can I Reach My Financial Goals?

Another way to increase your savings is by sticking to a planned budget. If you’ve never budgeted before, we can provide you a budgeting worksheet you can use to create your own plan along with five simple rules to follow when you’re saving. We recommend you:

- Identify Goals

- Record Expenses

- Record Earnings

- Compare and Calculate

- Fix Weak Spots

If you’re already budgeting, consider finding ways to tighten your spending a bit more to accelerate your journey to homeownership. After all, putting even a little extra into your savings each month can truly add up over time.

Bottom Line

As you set out to realize your dream of homeownership this year, know that it’s achievable with careful planning. Most importantly, call us today at Braceland Homes 619-947-3560 so you don’t have to walk alone on this journey. We can help you through all of it from start to finish!

Thursday, January 13, 2022

Two Ways Homebuyers Can Win in Today’s Market

Two Ways Homebuyers Can Win in Today’s Market

If your goal is to purchase a home this year, you might be looking for any advantage you can get in today’s sellers’ market. While competition is still fierce for homebuyers, there are ways you can win and secure the home of your dreams, even in a hot market.

Act Early and Save

The earlier you act this year, the more affordable your purchase will be. That’s because experts project mortgage rates will rise as we move deeper into 2022. According to Freddie Mac, the average 30-year fixed-rate mortgage is expected to be 3.5% by year’s end. Experts forecast home prices will rise as well.

That means the longer you wait, the more it will cost you to buy a home. Instead, act early and purchase your home before rates and prices rise further. Not to mention, the sooner you buy, the sooner you can experience the benefits of continued home price appreciation yourself. Once you have your home, you’ll be able to watch its value rise, giving you confidence that your investment is a sound one.

Buy Now, Move Later

Keep in mind, with high buyer demand like we’re seeing today, you’ll be competing against other potential homebuyers, which means you need to find a way to stand out. One way to accomplish this is to negotiate with sellers and present terms that meet their ideal needs. Danielle Hale, Chief Economist for realtor.com, explains one lever flexible buyers can pull to entice sellers:

“For buyers with more flexible timelines – such as those making a move from a big city – offering a couple extra months on the closing date could sweeten the deal for sellers who also need to buy their next home.”

In other words, if you’re eager to purchase a home now before it becomes more costly and you don’t have to move right away, you could extend the date of your closing and provide the seller with the time they need to find their next home. That’s a deal that could benefit both parties and help you stand out from the crowd.

Call or text us at 619-947-3560 for expert advice on how to make your best offer. At Braceland Homes, we know what’s working in this housing market and what may appeal to sellers.

Bottom Line

We project home prices and rates will increase in 2022. That means buyers who are ready should act soon and find ways to strengthen their offer to meet sellers’ needs. Call or text me at 619-947-3560 today to learn how you can win in today’s market.

Friday, January 7, 2022

Real Estate vs Stock Market What is the Best Investment for 2022

Tuesday, January 4, 2022

Why Selling Your House with a Real Estate Professional Is Essential

Why Selling Your House with a Real Estate Professional Is Essential

Selling your house is no simple task. And when you sell on your own – known as a FSBO (or For Sale by Owner) – you’re responsible for handling some of the more difficult aspects of the process without the expert guidance you need.

The 2021 Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) surveys homeowners who recently sold their house on their own and asks what difficulties they faced. Those sellers say some of the biggest headaches are prepping their house for sale, pricing it right, and handling the required paperwork.

Working with us at Braceland Homes is the best way to ensure you have an expert on your side to guide you at every turn. We have the skills and knowledge that are essential to navigating each step with ease, efficiency, and accuracy. Here are just a few things a real estate agent will do to make sure you get the most out of your sale.

1. Make the Best First Impression

Selling your house requires a significant amount of time and effort. Doing it right takes expertise and an understanding of today’s buyers. We know the answers to common questions, such as:

- Do I need to take down my personal art?

- How much landscaping does my house need?

- What colors should I paint my walls?

Your time and money are important, and you don’t want to waste either one focusing on the wrong things. We rely on our years of experience to answer these questions and more, allowing you to make the right investments to prep your house before you list.

2. Maximize Your Buyer Pool – and Your Sale

Today, the average home is getting 3.6 offers per sale according to recent data from NAR. That’s great news if you’re planning to sell, since the more offers you receive, the more likely you are to sell your house in a bidding war, and for a higher price.

At Braceland Homes, we have an assortment of tools at our disposal, like social media followers and agency resources, that will ensure your house is viewed by the most buyers. Without access to these tools and your our marketing expertise, your buyer pool – and your home’s selling potential – is limited.

3. Understand the Documentation, Including the Fine Print

Today, when a house is sold, more disclosures and regulations are mandatory, meaning the number of legal documents to juggle is growing. It’s hard to understand all the requirements and fine print (especially if you’re not an expert). That’s why we are an invaluable guide.

We know exactly what needs to happen, what all the paperwork means, and can work through it efficiently. We’ll help you review the documentation and avoid any costly missteps that could happen if you tackle it on your own.

4. Act as Your Expert Negotiator

If you sell on your own, you’ll also be solely responsible for all negotiations. That means you have to coordinate with:

- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Instead of going toe-to-toe with all these parties alone, lean on us. We rely on experience and training to make the right moves throughout the negotiation. We know what levers to pull, how to address each individual concern, and when you may want to get a second opinion. When you sell your house yourself, you’ll need to be prepared to have these conversations on your own.

5. Price It Right

At Braceland Homes we have the expertise to price your house accurately and competitively. To do so, we compare your house to recently sold homes in your area, factor in the current condition of your house, and analyze trending market data. These factors are key to making sure your house is priced to move quickly and get you the maximum return on your investment.

When you sell as a FSBO, you’re operating without this advantage. That could cost you in the long run if you price your house too high or too low.

Bottom Line

There’s a lot that goes into selling your house, and it takes time, effort, and expertise to truly maximize your sale. Instead of tackling it alone, call me direct at 619-947-3560 to make sure you have an expert on your side.

Monday, January 3, 2022

How Much Money Do You Need for a Down Payment on a Home?

How Much Money Do You Need for a Down Payment on a Home?

As you set out on your homebuying journey, you likely have a plan in place, and you’re working on saving for your purchase. But do you know how much you actually need for your down payment?

If you think you have to put 20% down, you may have set your goal based on a common misconception. Freddie Mac says:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

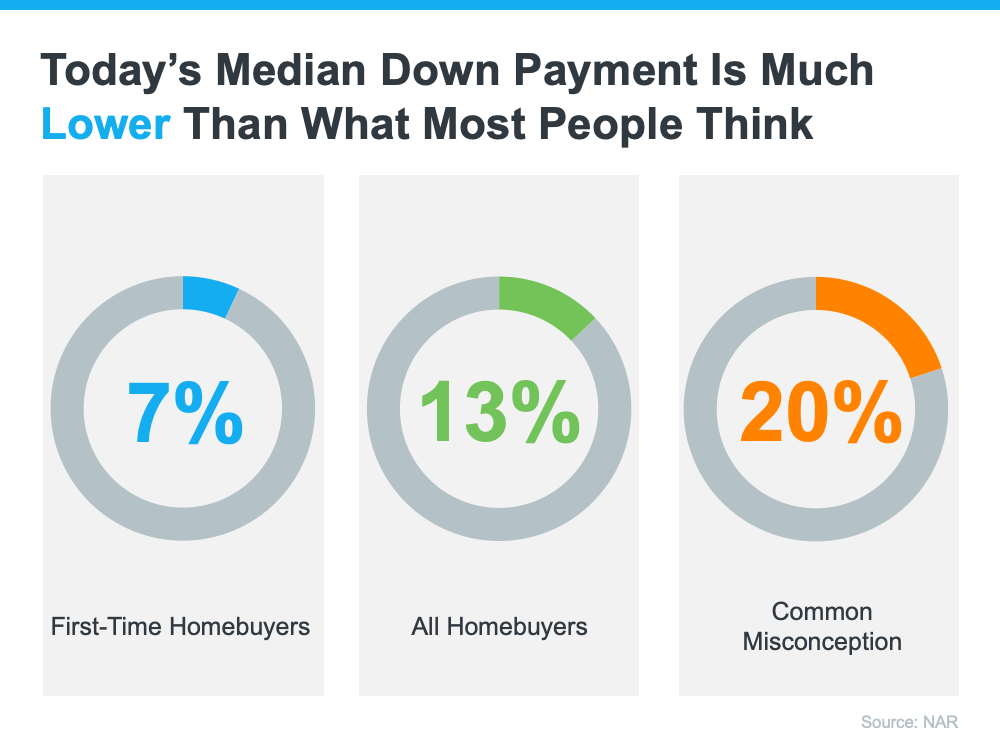

Unless specified by your loan type or lender, it’s typically not required to put 20% down. According to the Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. It may sound surprising, but today, that number is only 13%. And it’s even lower for first-time homebuyers, whose median down payment is only 7% (see graph below):

What Does This Mean for You?

While a down payment of 20% or more does have benefits, the typical buyer is putting far less down. That’s good news for you because it means you could be closer to your homebuying dream than you realize.

If you’re interested in learning more about low down payment options, there are several places to go. There are programs for qualified buyers with down payments as low as 3.5%. There are also options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, you need to do your homework...or you can call us at Braceland Homes 619-947-3560. If you’re interested in learning more about down payment assistance programs, we can also advise you on those. It's a good idea to work with us from the start to learn what you may qualify for in the homebuying process.

Bottom Line

Remember: a 20% down payment isn’t always required. If you want to purchase a home this year, give us a call at 619-947-3560 to start the conversation and explore your down payment options.

Escondido Hidden Hills Home For Sale – ½ Acre Finished Backyard with Waterfall & Sunset Views

Welcome to our blog, where we explore the finest real estate opportunities in Southern California. Today, we're thrilled to spotlight ...

-

Experience the perfect blend of convenience and comfort in this exceptional single-story 2-bed, 2-bath Escondido California home with a spac...

-

Welcome to picturesque Old Escondido, North County San Diego’s only Historic District! Escape the annoyances of apartment living in your o...

-

Nestled in the rolling hills of Escondido, Rancho San Pasqual is a gated community built around the scenic Dos Osos Golf Club, offering a ...